Stop Chasing Payments and Get Your Business Paid on Time

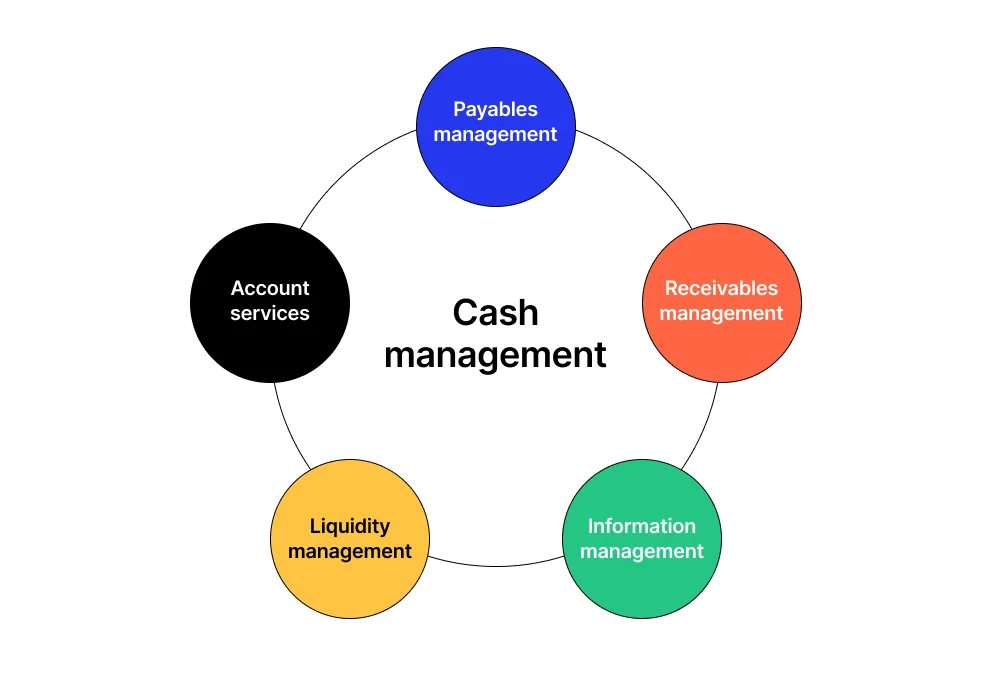

Key components of cash management include payables, receivables, information, liquidity, and account services

Picture this: You've just delivered excellent work for a client, your team crushed the project, and everyone's celebrating—but your bank account? Still waiting. If you're a small business owner watching invoices pile up while your cash flow trickles to a halt, you're experiencing one of the most frustrating challenges in business. The good news? It doesn't have to be this way.

Cash flow problems aren't just inconvenient—they're business killers. In fact, poor accounts receivable management is one of the top reasons profitable businesses fail. You might have plenty of revenue on paper, but if you can't collect what you're owed, you can't pay your bills, your employees, or invest in growth.

The Cash Flow Crunch: Why This Matters

Before we dive into solutions, let's talk about why this issue keeps small business owners up at night. Late payments create a domino effect: you can't pay suppliers on time, you miss growth opportunities, and you might even struggle to make payroll. When 30% or more of your invoices are past due, you're essentially running a bank for your clients—except you're not collecting interest.

Example of a professional small business invoice template showing how to structure billing with clear breakdowns of descriptions, quantities, prices, taxes, and totals

6 Strategies to Get Paid Faster

1. Invoice Promptly: Strike While the Iron Is Hot

The single biggest mistake small businesses make? Waiting to send invoices. Every day you delay is another day your payment gets pushed back. Send invoices immediately upon completion of work or delivery of products. Your client's approval is freshest right after you've delivered value, and prompt invoicing capitalizes on that momentum.

Pro tip: Automate your invoicing process so bills go out the same day work is completed. Many small businesses lose thousands annually simply because invoices sit in draft folders.

2. Clear Terms: Eliminate Confusion Before It Starts

Vague payment terms are an invitation for late payments. "Net 30" might seem standard, but does your client know what that means? Does it mean 30 days from invoice date, delivery date, or month-end?

Be crystal clear on every invoice:

Payment due date (specific calendar date, not just "Net 30")

Accepted payment methods

Late payment penalties or interest charges

Early payment discounts (if applicable)

When expectations are clear from day one, clients have no excuse for delays, and you have stronger ground to stand on when following up.

3. Follow-Up: The Systematic Approach That Works

Here's the uncomfortable truth: most businesses don't follow up consistently because it feels awkward. But a systematic, professional follow-up process removes the emotion and awkwardness from collections.

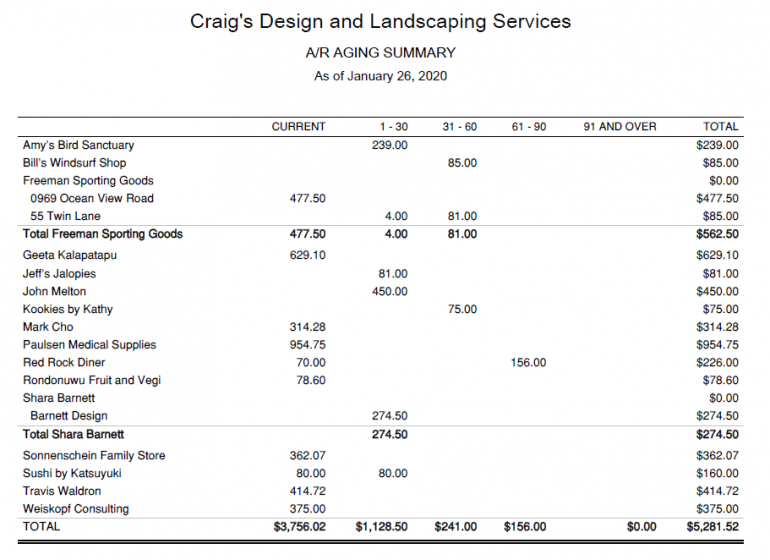

An accounts receivable aging summary report showing outstanding customer balances by aging categories for a landscaping business

Create a follow-up schedule:

Day 7 before due date: Friendly reminder email

Day 3 before due date: Second reminder with payment link

Due date: Invoice due today notification

Day 7 past due: First follow-up call

Day 15 past due: Formal notice with late fees

Day 30+ past due: Consider escalation options

4. Discounts: The Power of Incentives

Sometimes a small discount today is worth more than full payment next month. Offering a 2% discount for payment within 10 days can dramatically improve your cash flow. While you're sacrificing a small margin, you're gaining:

Predictable cash flow

Reduced collection costs

Stronger client relationships

Less time spent chasing payments

Calculate whether early payment discounts make sense for your business model. For many small businesses, the trade-off is absolutely worth it.

5. Outsourcing: When to Call in the Professionals

Some accounts become chronic problems—clients who consistently pay late or make excuses. These relationships drain your time, energy, and resources. At some point, you need to ask: is it worth it?

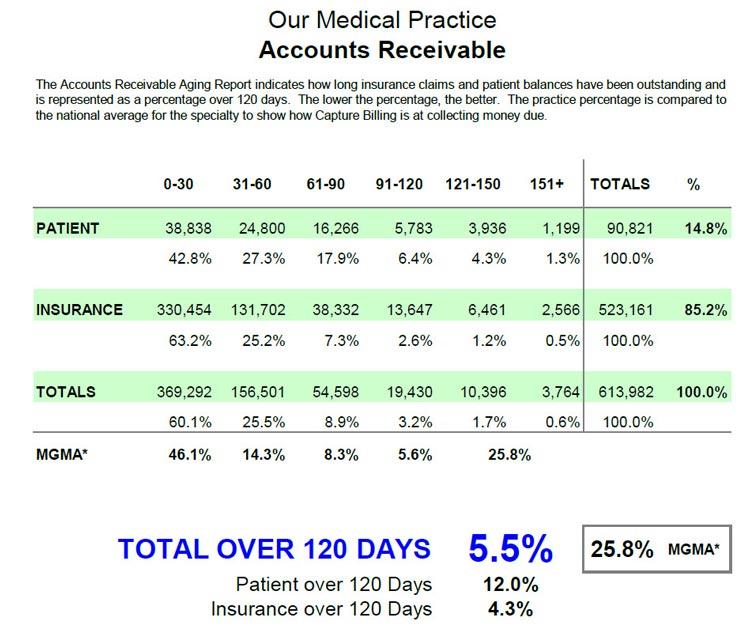

Accounts receivable aging report for a medical practice showing outstanding balances by aging period and comparison with industry benchmarks

Third-party collection services specialize in recovering difficult accounts professionally and legally. While they take a percentage of recovered funds, they free you up to focus on running your business rather than playing bill collector. Sometimes outsourcing is the smartest business decision you can make.

6. Periodic Review: Your Financial Early Warning System

Your accounts receivable aging report is like a business health check-up. Review it at least weekly, and you'll spot problems before they become crises.

Look for patterns:

Which clients consistently pay late?

Are certain services or products associated with payment delays?

Is your average collection period increasing?

What percentage of receivables are over 60 days old?

Regular analysis allows you to take proactive action—adjusting credit terms for problem clients, requiring deposits for certain projects, or even deciding to part ways with clients who don't value your time.

Taking Control of Your Cash Flow

Cash flow management involves monitoring cash inflows and outflows to improve financial stability and decision-making for better business outcomes

These six strategies aren't just theoretical—they're practical tools that small businesses use every day to maintain healthy cash flow and build sustainable growth. The businesses that thrive aren't necessarily the ones with the most clients or the highest revenue; they're the ones that get paid consistently and predictably.

At Accounting & Computer Concepts, LLC, we've helped countless small businesses transform their accounts receivable processes. Whether you need help setting up automated invoicing systems, creating effective collection procedures, or analyzing your aging reports, we're here to support you.

Ready to stop chasing payments and start growing your business? Visit us at www.acconcepts.info to learn how we can help you implement these strategies and build the financial systems your business deserves.

Remember: every dollar tied up in unpaid invoices is a dollar you can't invest in growth, innovation, or peace of mind. It's time to turn your accounts receivable process from a liability into an asset. Let's make your cash flow work for you—not against you.