Don't Ignore Small Deductions: The Hidden Tax Goldmine Every Small Business Misses

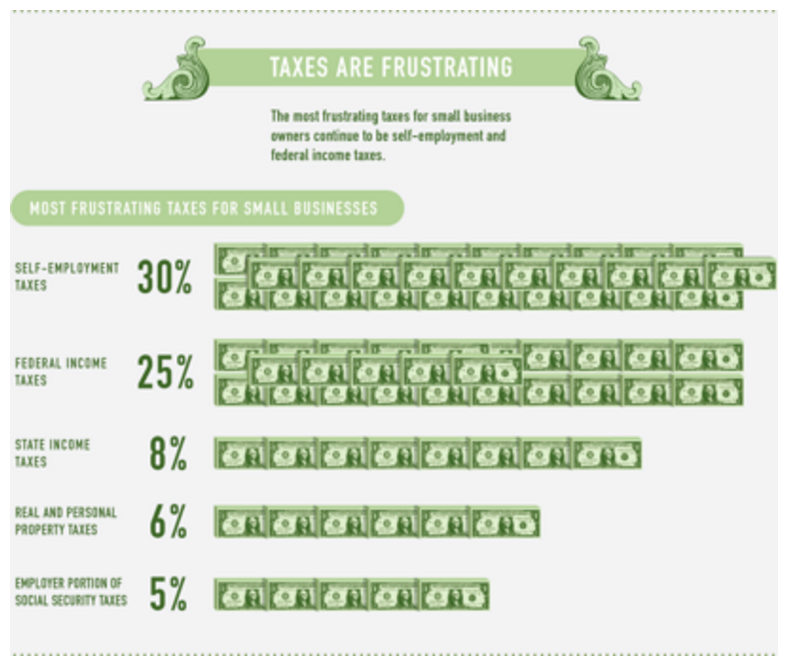

Infographic illustrating the most frustrating taxes for small business owners, highlighting self-employment and federal income taxes as top concerns

You know that feeling when you find a $20 bill in an old jacket pocket? That surprise money discovery might make your day, but what if I told you there's potentially thousands of dollars sitting right under your nose – money you're legally entitled to keep, but you're unknowingly handing over to the IRS every year?

Here's the uncomfortable truth: According to tax professionals, 90% of small business owners miss write-offs that could significantly reduce their tax burden. We're not talking about aggressive tax strategies or gray-area deductions. We're talking about legitimate, everyday business expenses that you're probably already paying for but forgetting to deduct.

The problem isn't that small business owners don't want to save money – it's that they don't realize how many perfectly ordinary expenses qualify as tax deductions. From that coffee you grabbed during a client meeting to the home internet you use for business calls, these "small" deductions add up to big savings that could mean the difference between struggling to make ends meet and having breathing room to grow your business.

The "Small Deduction" Myth That's Costing You Thousands

Let's start with a reality check. Many small business owners think certain expenses are "too small" to matter or "too complicated" to track. This mindset is expensive. Consider Sarah, a freelance marketing consultant who thought tracking her $3 daily coffee runs wasn't worth the hassle. By the end of the year, she'd missed out on deducting $780 in legitimate business meal expenses – money that could have saved her nearly $200 in taxes.

The truth is, small deductions compound quickly. When you're missing multiple categories of legitimate write-offs throughout the year, you're essentially giving the government an interest-free loan that you'll never get back.

The Home Office Deduction: Your Biggest Missed Opportunity

Nearly 40% of small businesses operate from home, yet many owners either don't claim the home office deduction or claim it incorrectly. The home office deduction isn't just for people with dedicated office spaces – it's for anyone who uses part of their home "exclusively and regularly" for business.

Here's where most people go wrong: they think their space needs to be a separate room. Not true. A corner of your bedroom that's used only for business qualifies. Your kitchen table where you do all your accounting? That only qualifies if you use it exclusively for business – which most people don't.

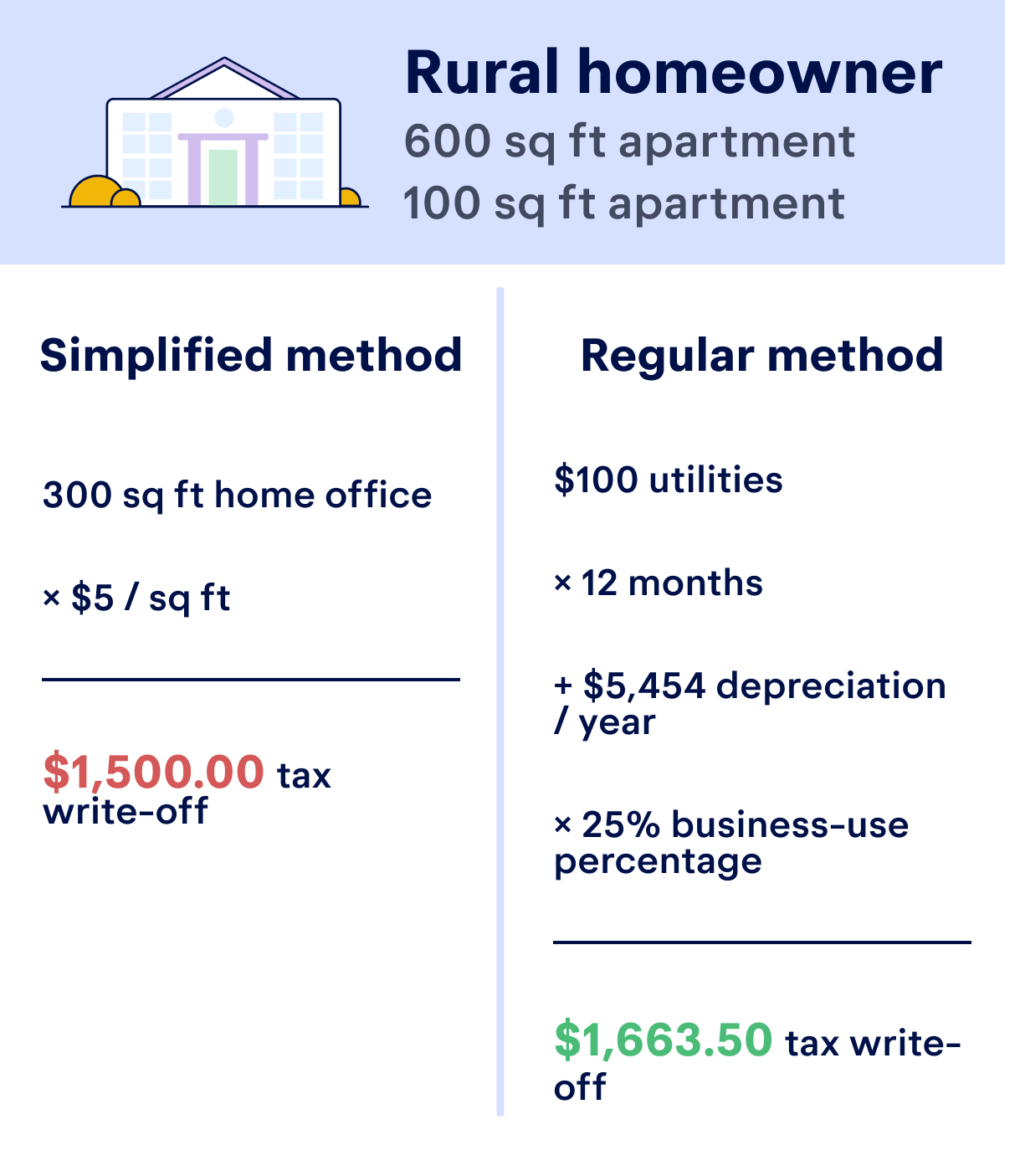

The simplified method allows you to deduct $5 per square foot up to 300 square feet, giving you a maximum deduction of $1,500. But many business owners who qualify for more money stick with the simplified method because they think the regular method is too complicated.

Comparison of simplified and regular methods for home office tax deductions for rural homeowners

Business Meals: The 50% Rule Everyone Gets Wrong

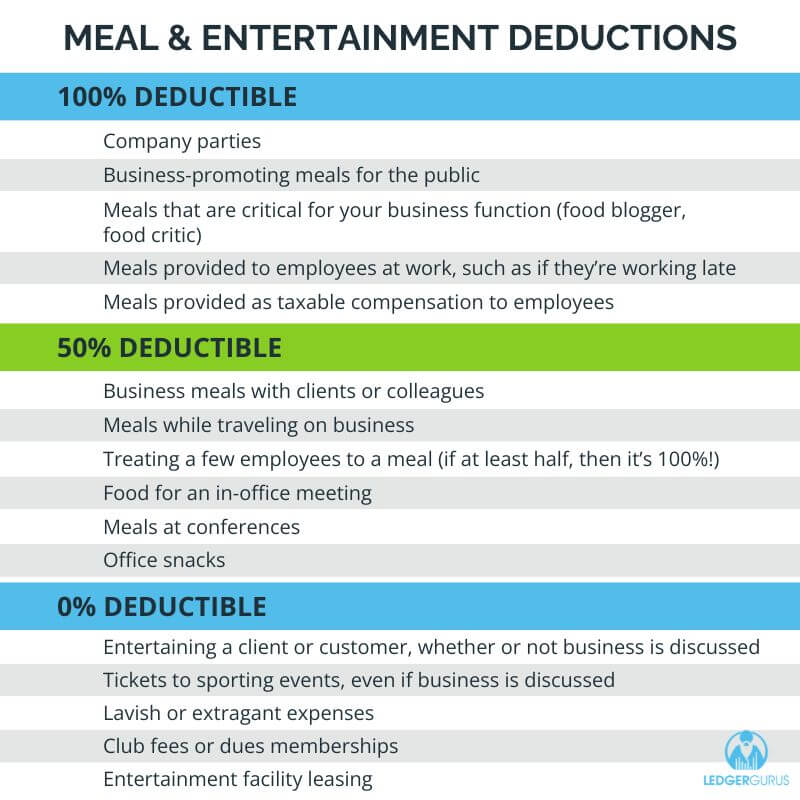

Meal and entertainment deductions categorized by their tax deductibility percentages for businesses

Business meals are 50% deductible, but here's what most small business owners miss: the meal doesn't have to be lavish or formal to qualify. That coffee meeting with a potential client? Deductible. The sandwich you grabbed while working late on a project? Deductible. The pizza you ordered for your team during a late-night push to meet a deadline? 100% deductible.

The key requirements are simple:

The expense must be ordinary and necessary for your business

You or an employee must be present

The expense cannot be lavish or extravagant

There must be a legitimate business purpose

Yet most small business owners only track formal business dinners, missing hundreds of dollars in legitimate meal deductions throughout the year.

The Documentation Problem That's Sabotaging Your Deductions

Example of a detailed business receipt useful for tracking expenses and documenting purchases for small businesses

Here's the thing about tax deductions: the IRS doesn't care how legitimate your expense was if you can't prove it. Poor record-keeping is one of the most significant tax mistakes a business can make, and it's the reason why many small businesses leave money on the table even when they know about available deductions.

The documentation requirements aren't as complicated as you might think, but they are specific:

For meals: Keep the receipt and note the business purpose and who attended

For travel: Document the business reason, dates, and costs

For equipment: Save receipts and note the business use percentage

For home office: Calculate the square footage and keep utility bills

The problem is that most small business owners try to reconstruct this information at tax time rather than capturing it as it happens. By then, details are fuzzy, receipts are lost, and legitimate deductions get skipped.

Startup Costs: The $5,000 First-Year Opportunity

If you started your business within the last year, you might be eligible for the startup costs deduction – up to $5,000 in the first year. This covers everything from market research and advertising costs to legal fees and office supplies incurred before your business officially opened.

But here's the catch: if your total startup costs exceed $50,000, your first-year deduction decreases dollar-for-dollar. Spend $53,000 on startup costs, and your first-year deduction drops to $2,000. Spend more than $55,000, and you lose the first-year deduction entirely.

Most new business owners either don't know about this deduction or miss the documentation requirements. The expenses must be:

Ordinary and necessary for your type of business

Incurred before the business began operations

Actually result in an active business (not just an idea that never launched)

The Vehicle Expense Choice That Could Save You Thousands

Business vehicle expenses offer two calculation methods, and choosing the wrong one can cost you hundreds or thousands in missed deductions. For 2025, the standard mileage rate increased to 70 cents per mile.

Here's the decision: take the standard mileage deduction or track actual expenses (gas, maintenance, insurance, depreciation). Most small business owners default to mileage tracking because it seems simpler, but actual expense tracking often results in larger deductions for vehicles used heavily for business.

Consider this example: if you drive 10,000 business miles per year, the standard deduction gives you $7,000. But if your actual vehicle expenses (gas, insurance, maintenance, depreciation) total $15,000 annually and you use the vehicle 60% for business, you could deduct $9,000 – $2,000 more than the mileage method.

The key is consistent tracking. Whether you choose mileage or actual expenses, you must keep detailed records from day one. You can't switch methods mid-year or reconstruct documentation after the fact.

Professional Development: The Investment That Pays for Itself

Education and training expenses are fully deductible when they maintain or improve skills needed in your business. This includes:

Industry conferences and workshops

Online courses and certifications

Professional memberships and subscriptions

Business books and publications

Many small business owners think these expenses are "personal development" rather than business expenses. But if the education directly relates to your current business, it's deductible. A marketing consultant taking a digital advertising course? Deductible. A restaurant owner attending a food safety seminar? Deductible.

The missed opportunity here is significant. Professional development expenses can easily total $2,000-$5,000 annually for an active small business owner, representing potentially $500-$1,250 in tax savings.

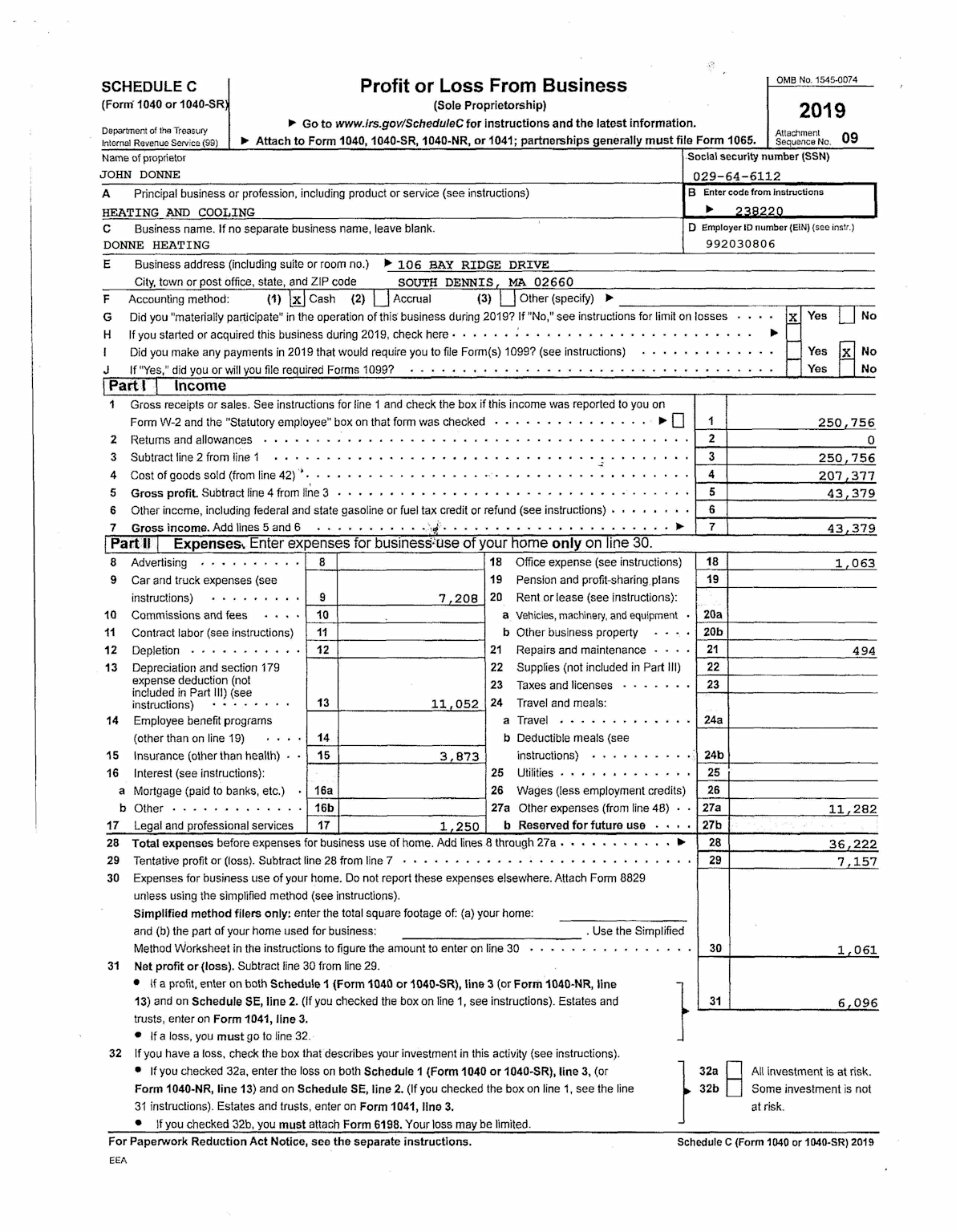

IRS Schedule C form for reporting profit or loss from a sole proprietorship, showing income and various deductible business expenses for tax filing

The Hidden Deductions Hiding in Plain Sight

Beyond the obvious categories, there are dozens of smaller deductions that most small businesses miss:

Bank and credit card fees: Monthly service charges, transaction fees, overdraft fees – all deductible if they're for business accounts

Software subscriptions: Everything from Adobe Creative Suite to project management tools to cloud storage

Professional services: Accounting, legal, consulting – not just the big bills, but also smaller advisory sessions

Insurance premiums: General liability, professional liability, equipment insurance – all fully deductible

Office supplies: Not just paper and pens, but also small equipment, furniture, and technology under certain dollar thresholds

Phone and internet: The business portion of your monthly bills, often overlooked by home-based businesses

The Automation Solution That Captures Every Deduction

The biggest reason small businesses miss deductions isn't lack of knowledge – it's lack of systems. Successful deduction tracking requires capturing expenses as they happen, not trying to remember them months later.

Modern expense management tools can automatically categorize transactions, capture receipts via photo, and track business use percentages. But the key is setting up categories that match common small business deductions and training yourself to use the system consistently.

Consider setting up automatic categorization for:

Business meals (with photo receipt capture)

Vehicle expenses (with mileage tracking)

Professional development

Office supplies

Software subscriptions

Professional services

The Bottom Line: Small Deductions, Big Impact

Here's what most small business owners don't realize: missing deductions isn't just about paying more taxes this year – it's about having less cash flow to invest in growing your business. Every dollar you pay in unnecessary taxes is a dollar that can't be reinvested in marketing, equipment, or hiring.

The solution isn't complicated, but it does require changing your mindset from "tax season scramble" to "year-round tax strategy." Start tracking expenses immediately, understand what qualifies as deductible, and maintain proper documentation.

Remember, the IRS allows these deductions because legitimate business expenses reduce your taxable income. You're not gaming the system – you're taking advantage of deductions specifically designed to help small businesses succeed.

Don't let another year pass by with money sitting on the table. The small deductions you ignore today could be the difference between struggling to pay quarterly taxes and having the cash flow freedom to invest in your business's future. Every receipt matters, every mile counts, and every legitimate business expense deserves to be captured.

Don't let another month of missed deductions drain your profits and damage your cash flow. The strategies outlined in this post can save you thousands of dollars annually in tax savings – but implementing them correctly requires more than just good intentions. At Accounting & Computer Concepts, we've helped hundreds of small businesses uncover overlooked deductions and set up systems that capture every legitimate write-off throughout the year. Whether you're struggling with documentation requirements, unsure about qualification rules, or simply tired of leaving money on the table at tax time, we can show you exactly how to maximize your deductions while staying fully compliant with IRS requirements.

Ready to stop missing deductions and start keeping more of your hard-earned money? Click below to schedule your free 30-minute consultation, and let's discuss how to turn your everyday business expenses into maximum tax savings.