The Hidden Costs of "I'll Pay Tomorrow": How Late Payments Are Slowly Crushing Small Businesses

Circular diagram showing components of a cash flow statement: sources of cash, uses of cash, and change in cash balance

The clock strikes 5 PM on another busy Friday, and you're rushing to close out the week. Bills are stacked on your desk, invoices are piling up in your email, and that nagging thought creeps in: "I'll deal with these payments on Monday." Sound familiar? If you're nodding along, you're not alone – and you might be unknowingly putting your business at serious risk.

The reality is stark: According to recent Federal Reserve data, 80% of small businesses face payments-related challenges, and 56% consider cash flow and invoice payment management an ongoing pain point. But here's what many business owners don't realize – the "pay bills on time" problem isn't just about avoiding a few late fees. It's about protecting the very foundation of your business's financial health.

The Domino Effect: When Good Intentions Meet Bad Timing

Let's be real for a moment. As small business owners, we're constantly juggling a dozen different priorities. You're serving customers, managing employees, and trying to grow your business. Paying bills feels like just another administrative task that can wait until "tomorrow." But that tomorrow mindset is creating a cascade of problems that extend far beyond your immediate cash flow.

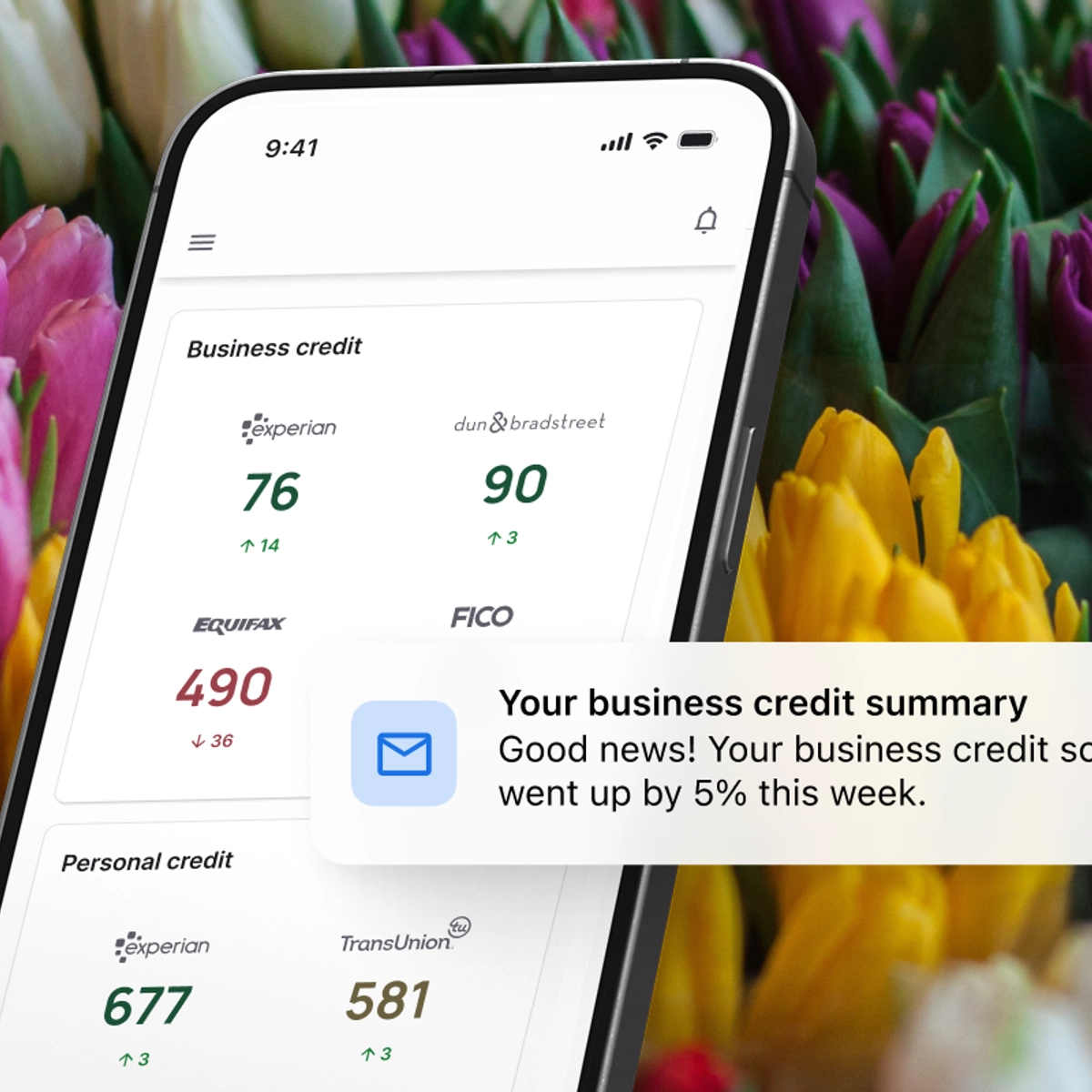

Smartphone display of business and personal credit scores alongside a notification of business credit improvement

Your Credit Score is Taking Silent Hits

Here's something that might surprise you: even payments that are just a few days late can impact your business credit scores. And unlike your personal credit, business credit rules are often harsher. While consumer credit cards must wait 60 days before applying penalty rates, business credit cards can hit you with penalty APRs of 29.99% or more after just one missed payment.

The numbers are sobering. Research shows that it can take up to six months for your PayDex score to recover from late payments. That's six months of potentially higher interest rates, unfavorable lending terms, and damaged supplier relationships – all from what you thought was just a "small delay."

The Supplier Relationship Strain

When you pay suppliers late, you're not just affecting your own business – you're disrupting their cash flow too. Nearly 86% of businesses report that up to 30% of their monthly invoiced sales are overdue, and many suppliers are getting fed up. In fact, 60% of businesses report trust issues with late-paying customers.

Think about it from your supplier's perspective: they have their own bills to pay, employees to compensate, and cash flow to manage. When you delay payments, you're essentially asking them to finance your operations. This strain often leads to suppliers imposing stricter payment terms for habitual late payers, or worse, terminating relationships altogether.

Business handshake illustration signifying a partnership in construction and industrial sectors

The Real Cost of "Just a Few Days Late"

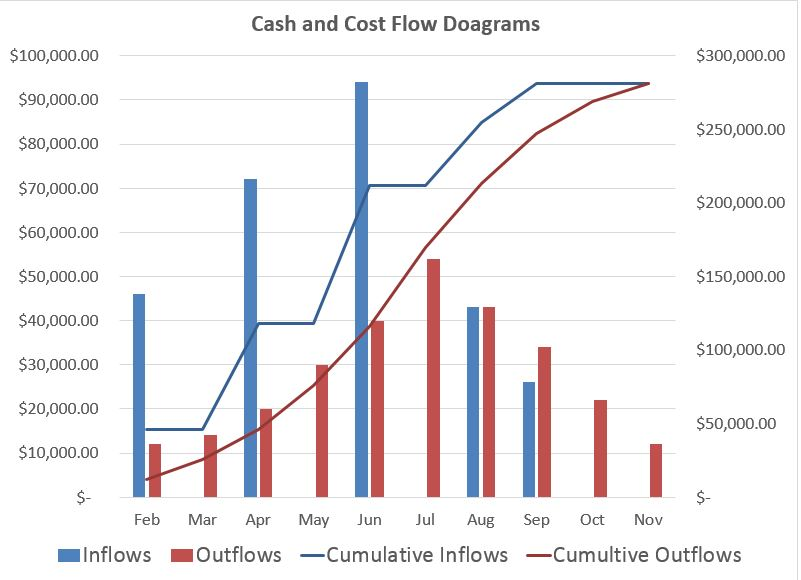

Monthly cash and cost flow diagram showing inflows, outflows, and cumulative totals over several months

The financial impact of late payments goes far beyond the obvious late fees. Let's break down the true cost:

Direct Financial Penalties: Late payment fees can average $500 per invoice. For a business paying 20 bills per month, just being late on half of them could cost an additional $5,000 monthly.

Missed Discount Opportunities: Many suppliers offer early payment discounts, typically 2% for payments within 10 days. Miss these, and you're essentially paying a premium for delayed cash flow management.

Increased Borrowing Costs: Late payments damage your business credit, leading to higher interest rates on future financing. Consider this example: if your credit score drops and your loan interest rate increases from 5% to 7% on a $100,000 business loan, you're paying an extra $2,000 annually just in interest.

Operational Disruptions: 30% of businesses report production delays due to vendor disputes over late payments. When suppliers start demanding payment upfront or refuse to deliver until past-due amounts are settled, your entire operation can grind to a halt.

The Modern Solution: Working Smarter, Not Harder

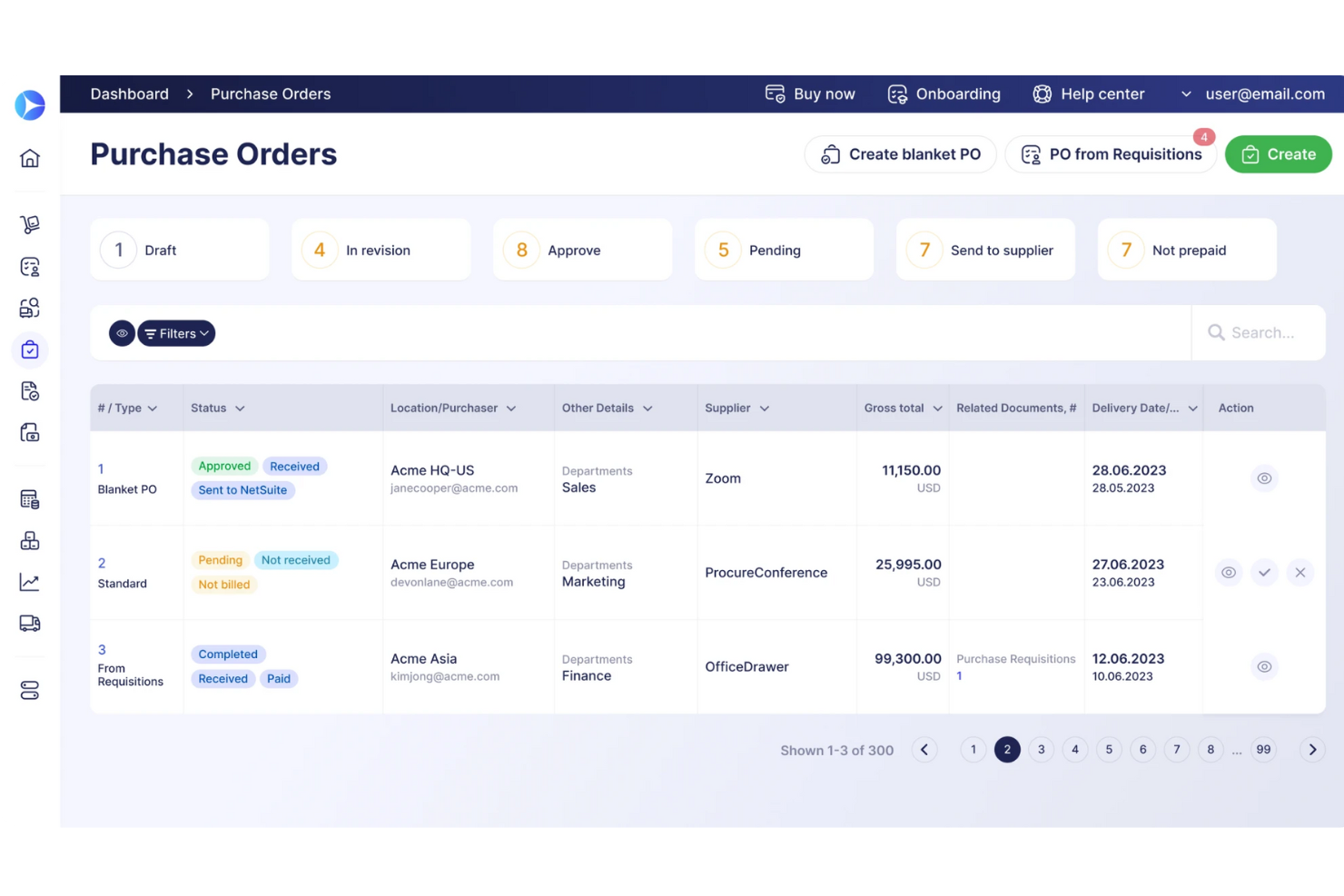

User interface of purchase orders management in accounts payable automation software

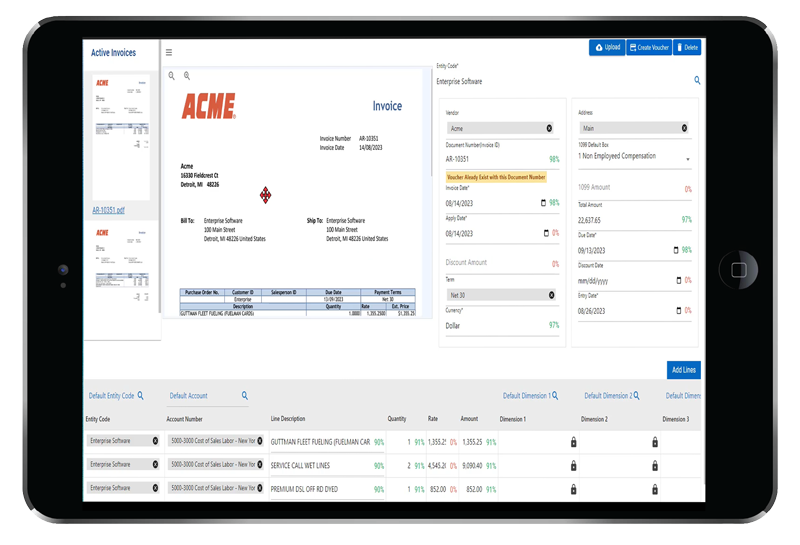

The good news? You don't have to choose between growing your business and managing your bills effectively. The solution isn't working longer hours or hiring more staff – it's working smarter with the right systems in place.

Automation: Your New Best Friend

85% of executives at mid-sized firms report that accounts payable automation is paramount for efficient processes. Nearly three-quarters say automation improves cash flow, boosts savings, or increases business growth. Modern bill payment platforms like Bill.com, Melio, and integrated solutions within QuickBooks Online can automatically schedule payments, send approval alerts, and sync with your accounting system.

Bill payment automation software interface displayed on a tablet screen showing invoice details, vendor information, and line item entries

Strategic Payment Timing

Instead of paying everything as it comes in or waiting until the last minute, consider optimizing your payment schedule. This means:

Negotiating better payment terms with suppliers based on your cash flow cycle

Taking advantage of early payment discounts when your cash position allows

Scheduling payments to align with your revenue collections

Using credit cards strategically for payments even when cards aren't accepted, giving you additional float time

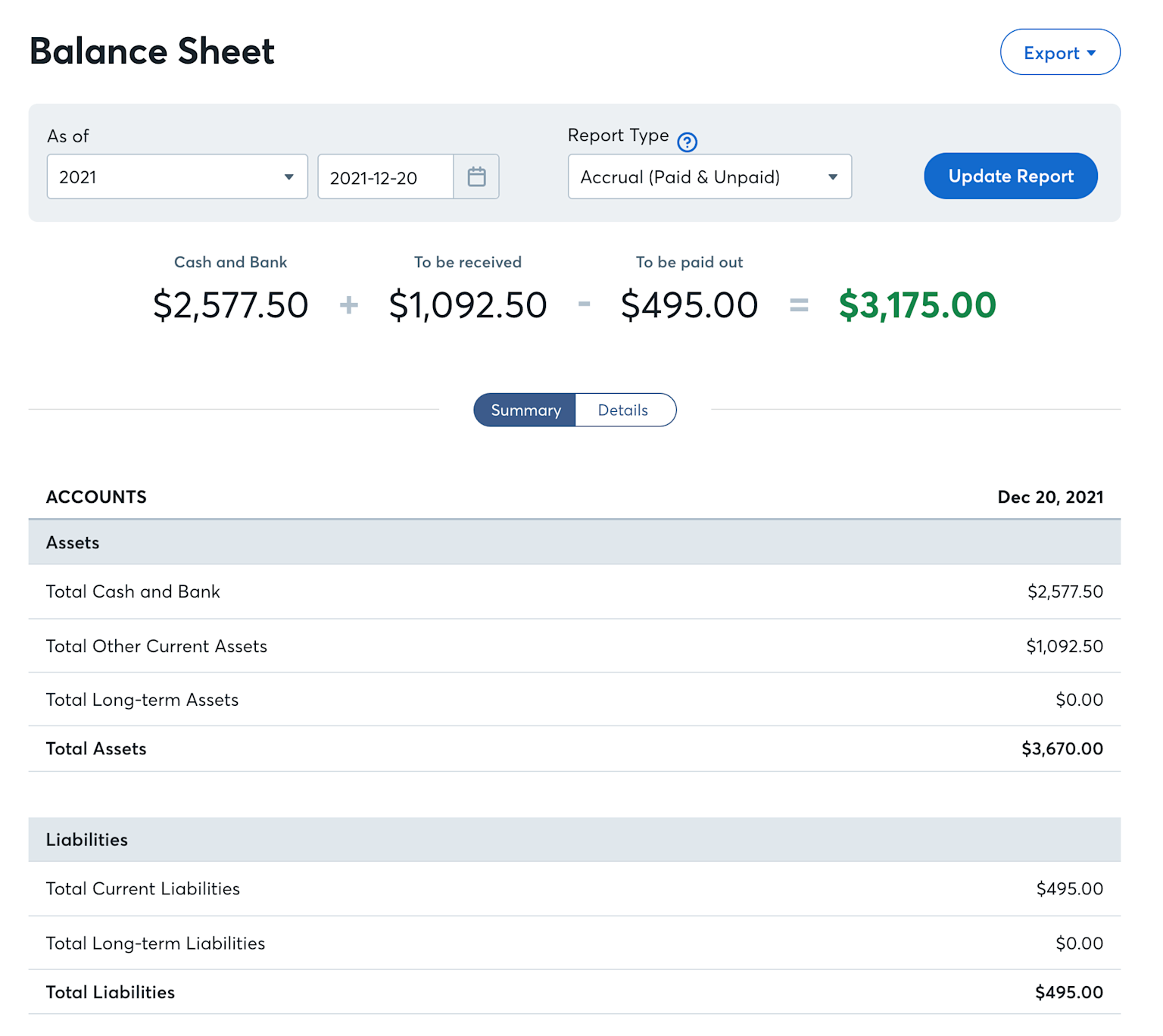

The Cash Flow Visibility Game-Changer

One of the biggest challenges small businesses face is the lack of real-time visibility into their payables. When you can't see what's due when, it's impossible to make informed decisions about payment timing. Modern accounting platforms provide up-to-date accounts payable aging reports that show exactly what you owe, when it's due, and how it impacts your cash position.

Building Your Payment Resilience Strategy

A detailed digital balance sheet report showing assets, liabilities, and net balance for a small business as of December 2021

Creating a sustainable bill payment system isn't about perfection – it's about building resilience into your processes. Here's how to get started:

1. Centralize Everything: Stop managing bills across multiple systems, email inboxes, and paper stacks. Centralized payment systems reduce administrative burden and provide better visibility.

2. Set Up Automated Alerts: Configure your system to alert you before bills are due, not after. Most platforms allow customizable reminders 7, 3, and 1 day before due dates.

3. Create Approval Workflows: If multiple people are involved in payment approvals, set up digital approval workflows that prevent bottlenecks and ensure bills don't sit in someone's inbox for days.

4. Monitor Your Cash Flow: Implement weekly cash flow reviews to understand your payment capacity and identify potential cash crunches before they happen.

5. Build Supplier Relationships: Communicate proactively with key suppliers about your payment processes. Many are willing to work with businesses that are transparent about their cash flow cycles.

The Bottom Line: Pay Now or Pay More Later

The cost of poor bill payment management extends far beyond late fees. It impacts your credit, strains supplier relationships, increases borrowing costs, and can even disrupt your operations. In an economic environment where 43% of small businesses consider cash flow a problem, you can't afford to let payment management be an afterthought.

But here's the encouraging news: the tools and strategies to solve these challenges are more accessible than ever. You don't need a massive budget or a dedicated finance team. You just need to recognize that paying bills on time isn't just about avoiding penalties – it's about building the financial foundation that allows your business to thrive.

The question isn't whether you can afford to invest in better payment management systems. The question is whether you can afford not to. Because in business, as in life, the costs of doing nothing are often far higher than the investment required to do things right.

Ready to take control of your payment processes? Start with a simple audit of your current bills and payment timelines. You might be surprised by what you discover – and how much money you can save by making a few strategic changes.

Don't let another month of late payments drain your profits and damage your business reputation. The strategies outlined in this post can save you thousands of dollars annually in late fees, early payment discounts, and improved borrowing terms – but implementing them correctly requires more than just good intentions. At Accounting & Computer Concepts, we've helped hundreds of small businesses transform their chaotic bill payment processes into streamlined, automated systems that actually improve cash flow rather than strain it. Whether you're dealing with vendor relationship issues, struggling with cash flow visibility, or simply tired of the monthly scramble to keep up with payments, we can show you exactly how to build a payment system that works for your specific business needs. Ready to stop playing catch-up with your bills and start getting ahead of your cash flow? Click the button above to schedule your free 30-minute consultation, and let's discuss how to turn your payment challenges into competitive advantages.