The Hidden Costs of Poor Cash Flow

Every business owner knows that gut-wrenching feeling when you check your bank account and the numbers don't match what's owed to you. You've delivered excellent service, sent out invoices, but the cash just isn't flowing in. Sound familiar? If you're nodding along, you're not alone – and more importantly, you're not stuck with this problem.

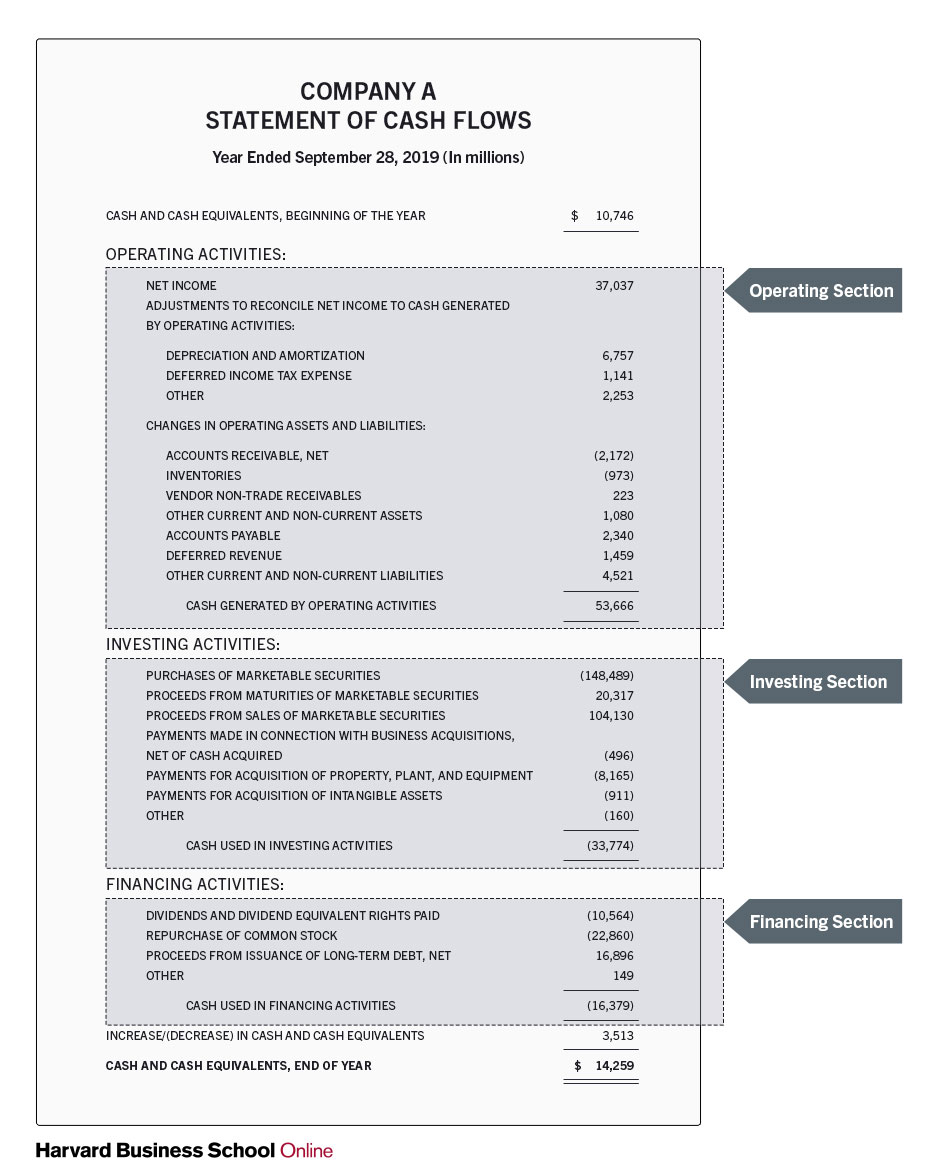

Cash flow statement example breaking down operating, investing, and financing activities for a company's fiscal year

Cash flow management isn't just about keeping your doors open – it's about positioning your business for sustainable growth and long-term success. Recent studies show that effective accounts receivable monitoring can reduce payment delays by up to 30% while significantly improving overall cash flow stability. The difference between businesses that thrive and those that merely survive often comes down to how well they manage the money flowing in and out of their operations.

The Real Impact of Cash Flow Challenges on Your Business

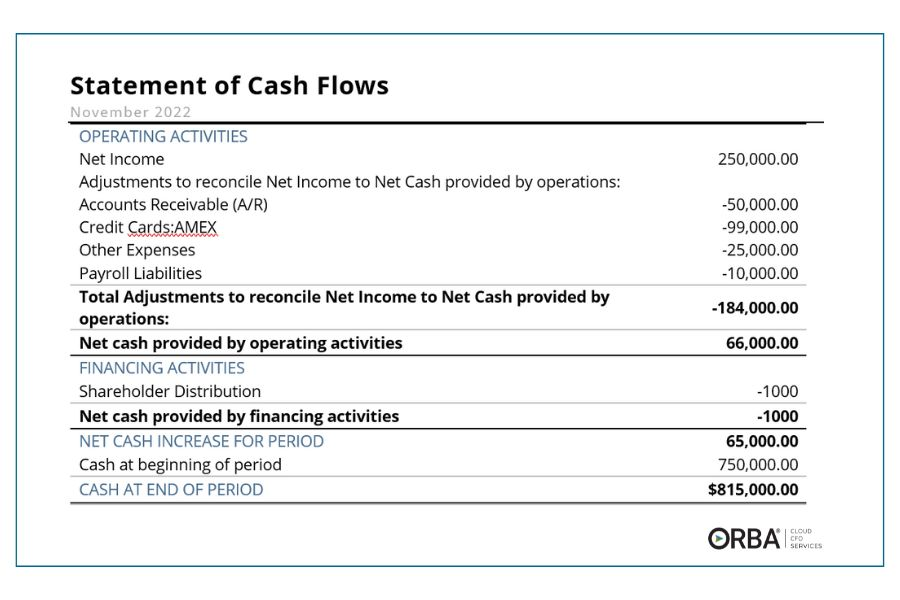

Statement of cash flows for November 2022 showing operating and financing activities and net cash changes

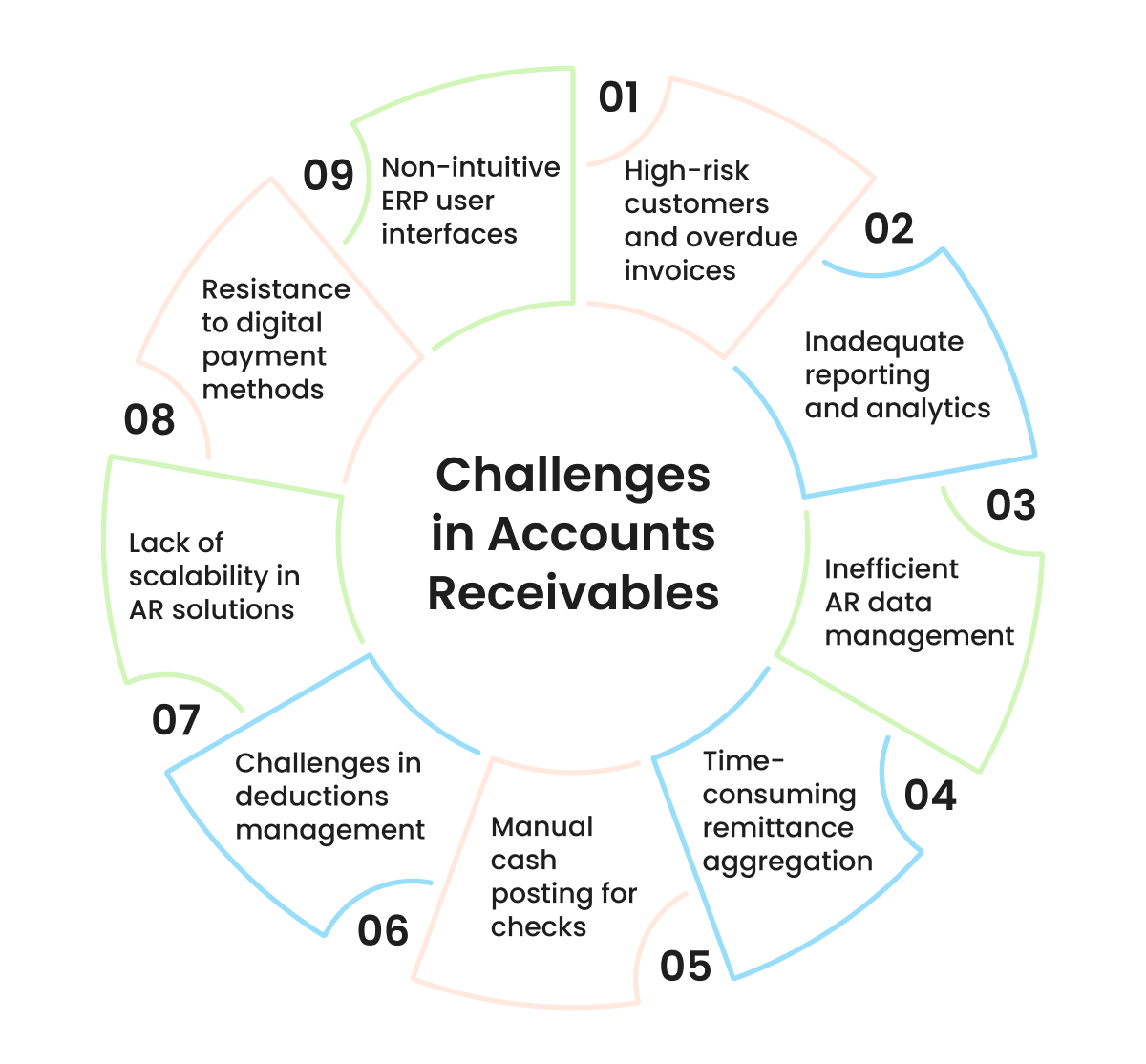

Managing cash flow effectively is more than just an accounting exercise – it's the lifeblood of your business operations. When accounts receivable sit unpaid for extended periods, the ripple effects can be devastating to your company's financial health and growth potential.

Cash flow problems create a domino effect throughout your entire business structure. When customers delay payments, you're forced to delay your own vendor payments, potentially damaging crucial supplier relationships. This can lead to unfavorable payment terms, loss of early payment discounts, and in severe cases, disruption of your supply chain. The stress of constant cash flow uncertainty also takes a personal toll on business owners, affecting decision-making capabilities and overall business strategy.

The hidden costs extend far beyond immediate operational challenges. Poor cash flow management often prevents businesses from taking advantage of growth opportunities, whether that's investing in new equipment, expanding product lines, or hiring additional staff. Many thriving businesses have missed game-changing opportunities simply because they couldn't access the cash that was technically theirs – it was just sitting in unpaid invoices.

Understanding the Root Causes of Payment Delays

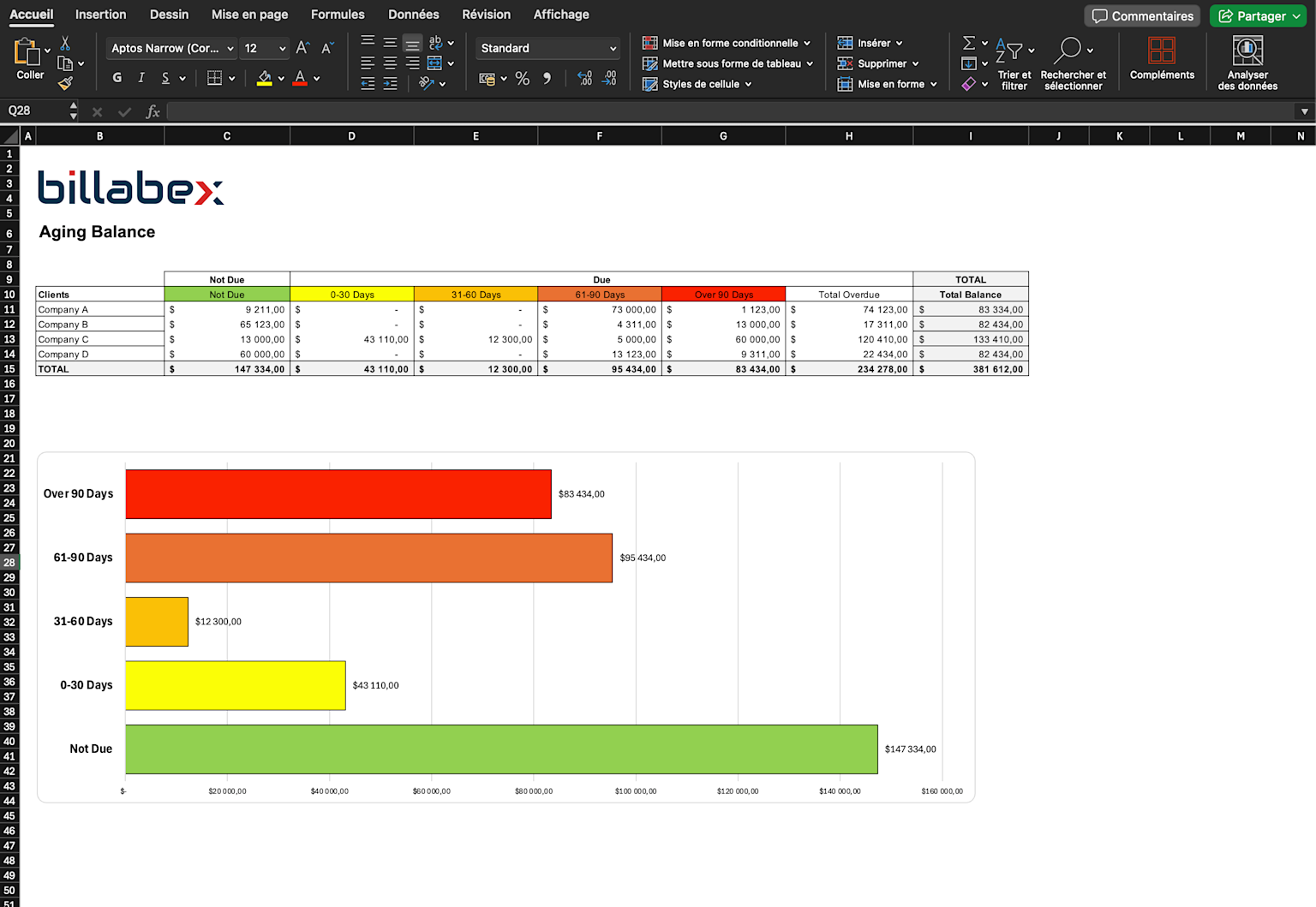

Excel aging balance report showing overdue receivables and color-coded aging categories with a corresponding bar chart

Before you can solve your cash flow challenges, it's crucial to understand why customers delay payments in the first place. The reasons are more varied than many business owners realize, and addressing them requires a strategic approach.

The most common payment delay triggers often stem from unclear communication and processes rather than malicious intent. Many customers genuinely want to pay on time but encounter barriers that make prompt payment difficult. These barriers include confusing invoice layouts, limited payment options, unclear payment terms, or simply forgetting when payments are due. Understanding that most payment delays aren't intentional can help you approach solutions with a collaborative rather than combative mindset.

Operational factors within customer businesses also play a significant role. Many companies operate on tight approval processes, where multiple stakeholders must review and approve payments. If your invoice arrives during busy periods or gets lost in bureaucratic processes, delays become inevitable. Additionally, seasonal cash flow fluctuations in your customers' industries can create predictable patterns of payment timing that you can plan around.

Technology-Driven Solutions for Modern Cash Flow Management

Ten practical strategies to improve cash flow for small businesses presented in a colorful circular infographic

The digital transformation of business operations has revolutionized how companies can manage their accounts receivable. Modern technology offers sophisticated tools that can automate much of the heavy lifting involved in invoice management and payment collection.

Automated invoicing systems have become game-changers for businesses of all sizes. These platforms can generate and send invoices immediately upon service completion or product delivery, eliminating the delays that often occur with manual processes. Real-time tracking capabilities allow you to monitor invoice status, identify potential delays before they become problems, and maintain comprehensive records of all customer communications. Integration with accounting software ensures that every transaction is properly recorded and easily accessible for analysis.

Advanced systems also leverage artificial intelligence to predict payment behaviors and identify customers who are likely to pay late. This predictive capability allows you to take proactive measures, such as following up earlier with specific customers or adjusting payment terms for habitual late payers. The data these systems collect becomes invaluable for making informed decisions about credit policies and customer relationships.

Building Stronger Customer Relationships Through Clear Communication

Effective cash flow management isn't just about systems and processes – it's fundamentally about building strong relationships with your customers based on clear communication and mutual respect. When customers understand your expectations and feel valued in the relationship, they're significantly more likely to prioritize your invoices.

Proactive communication starts long before the first invoice is sent. During the initial client onboarding process, establish clear expectations about payment terms, preferred payment methods, and the consequences of late payments. This conversation should feel collaborative rather than threatening, positioning yourself as a partner in their success while protecting your own business interests. Document these agreements clearly in contracts and reference them consistently in all future communications.

Regular check-ins with key customers can prevent many payment issues before they develop. A simple phone call to confirm receipt of an invoice and ask if there are any questions can resolve potential disputes early. These touchpoints also provide opportunities to strengthen the business relationship, potentially leading to increased orders or referrals. When customers view you as a trusted partner rather than just another vendor, your invoices naturally receive higher priority in their payment processes.

Implementing Strategic Payment Incentives and Policies

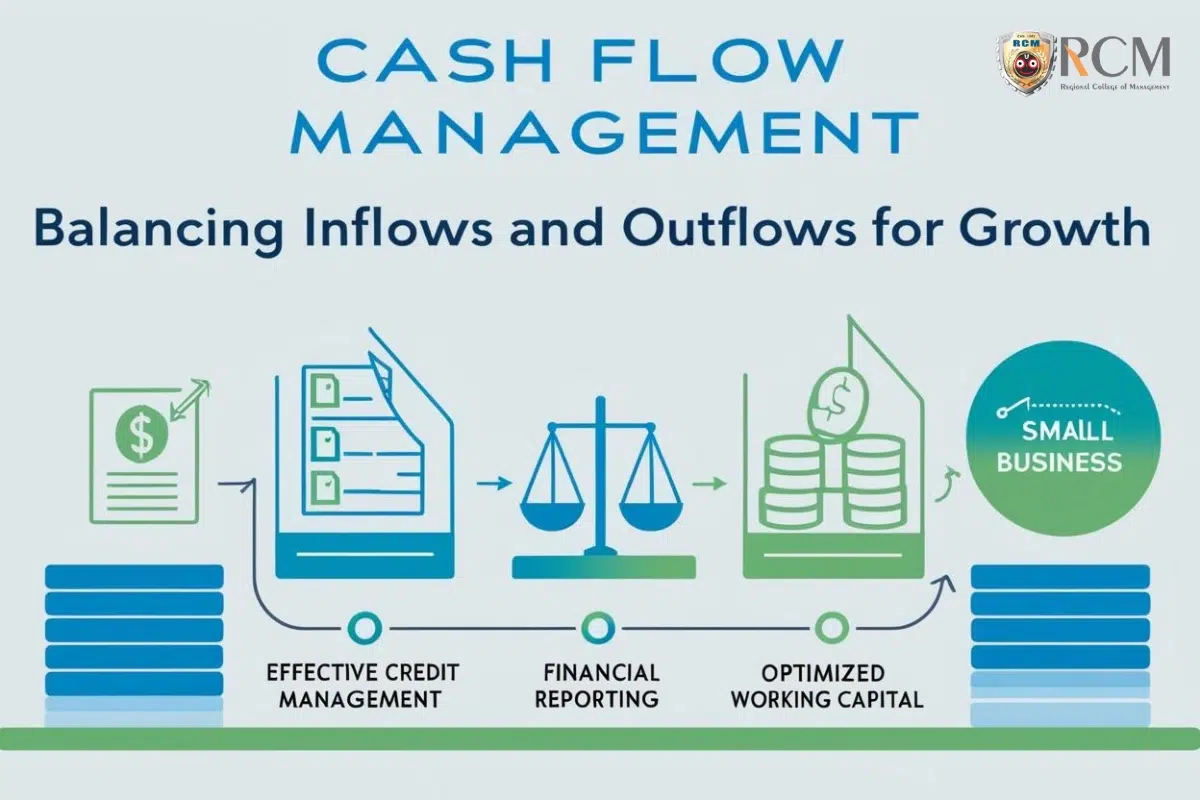

Infographic illustrating cash flow management steps for small business growth: effective credit management, financial reporting, and optimized working capital

Smart business owners understand that carrots often work better than sticks when it comes to encouraging prompt payments. Strategic incentives can transform your cash flow while strengthening customer relationships.

Early payment discounts represent one of the most effective tools for accelerating cash flow. Offering terms like "2/10 net 30" (2% discount if paid within 10 days, otherwise full payment due in 30 days) can significantly reduce your average collection period. While you're giving up a small percentage of revenue, the improved cash flow often more than compensates for the discount through reduced borrowing costs, improved vendor relationships, and increased operational flexibility.

Multiple payment options remove barriers that might otherwise delay payments. Modern customers expect convenience, and businesses that offer online payment portals, automatic payment options, and mobile-friendly payment methods consistently see faster collection times. The investment in payment technology typically pays for itself through reduced administrative costs and improved cash flow timing.

Monitoring and Analysis: The Key to Continuous Improvement

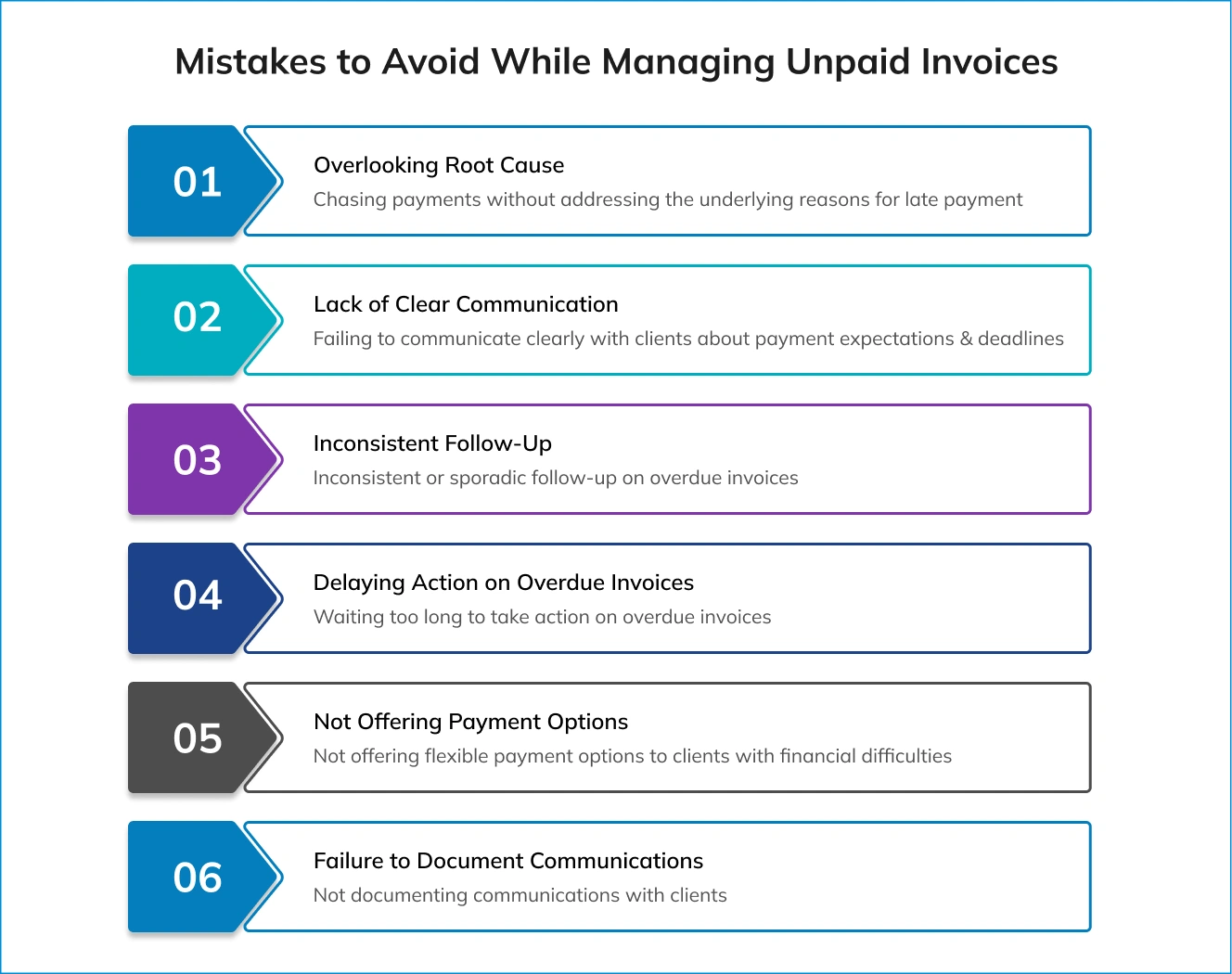

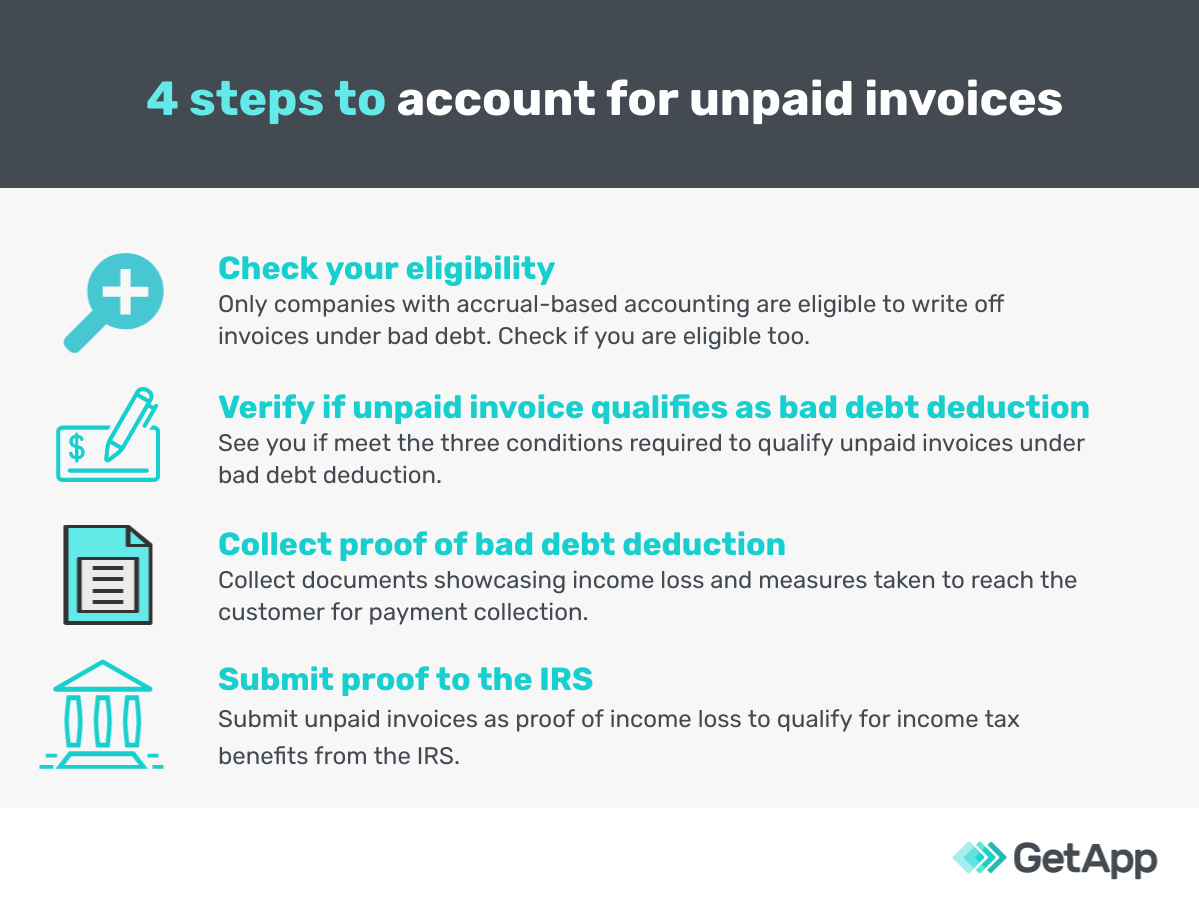

Four steps for business owners to account for unpaid invoices and qualify for bad debt deductions

Effective accounts receivable management requires ongoing monitoring and analysis to identify trends, spot problems early, and continuously improve your processes. The businesses that excel in cash flow management treat it as an ongoing strategic priority rather than a set-it-and-forget-it system.

Key performance indicators provide the roadmap for cash flow optimization. Metrics such as Days Sales Outstanding (DSO), average collection period, and aging reports reveal patterns in your cash flow that might not be immediately obvious. Regular analysis of these metrics helps you identify which customers consistently pay late, which payment terms work best, and where your processes might need adjustment. This data-driven approach takes the guesswork out of cash flow management and provides concrete evidence for business decisions.

The seasonal nature of many businesses creates predictable cash flow patterns that savvy owners can plan around. Understanding when your customers' busy seasons occur, when they typically have cash flow challenges, and how external factors affect their payment behavior allows you to adjust your strategies accordingly. This might mean tightening credit terms during certain periods, adjusting your own cash reserves, or timing major expenditures to align with stronger cash flow periods.

Creating a Comprehensive Cash Flow Management System

The most successful businesses approach cash flow management as an integrated system rather than a collection of disconnected processes. This holistic approach ensures that every aspect of your business operations supports healthy cash flow.

A comprehensive system starts with clear policies and procedures that everyone in your organization understands and follows consistently. These policies should cover customer onboarding, credit approval processes, invoice generation and delivery, payment follow-up procedures, and collection strategies. When everyone knows their role in the cash flow management process, fewer invoices slip through the cracks and customers receive consistent messaging about your payment expectations.

Regular team training ensures that your cash flow management system remains effective as your business grows and evolves. Staff members who understand the importance of prompt invoicing, accurate record-keeping, and professional customer communication become valuable assets in your cash flow management efforts. Additionally, having backup procedures and cross-trained staff ensures that your cash flow management continues even during vacation periods or staff changes.

Taking Action: Your Next Steps Toward Better Cash Flow

Understanding the principles of effective cash flow management is just the first step – the real value comes from implementation. The businesses that see dramatic improvements in their cash flow are those that take decisive action to implement these strategies systematically.

The most impactful changes often start with simple improvements to your current processes. Begin by reviewing your current payment terms and invoice procedures to identify obvious inefficiencies. Are you sending invoices promptly after service delivery? Do your invoices clearly communicate payment expectations? Are you following up on overdue payments consistently? Small improvements in these areas can yield immediate results while you work on implementing more sophisticated systems.

Consider partnering with professionals who specialize in cash flow management and business financial systems. An experienced consultant can help you identify the specific challenges affecting your business, recommend appropriate technology solutions, and develop customized strategies that align with your industry and customer base. The investment in professional guidance often pays for itself quickly through improved cash flow and reduced administrative burden.

Your business deserves the stability and growth potential that comes with excellent cash flow management. Don't let another month pass wondering when those outstanding invoices will be paid. Take control of your cash flow today by scheduling a free 30-minute consultation to discuss your specific challenges and develop a customized solution that works for your business. The conversation costs nothing, but the insights you'll gain could transform your business operations and peace of mind.

During this consultation, we'll review your current accounts receivable processes, identify immediate improvement opportunities, and develop a strategic plan for implementing the cash flow management systems that will support your long-term success. Your business growth shouldn't be held hostage by unpaid invoices – let's work together to create the financial stability your business deserves.