Why Transparency Beats Volatility Every Time

Picture this: You're sitting across from an investor, and they're flipping through your financial reports. Suddenly, they look up with concern. "Your earnings are all over the place—is everything okay?" You smile and say, "Yes, because at least you can see what's really happening." That's the power of transparent accounting.

Here's a truth that accountants everywhere know but business owners sometimes misunderstand: Accounting doesn't create chaos in your numbers. It just makes the chaos visible.

As Charles Lyell wisely put it, "Accounting does not make corporate earnings or balance sheets more volatile. Accounting just increases the transparency of volatility in earnings." Let me break down why this distinction matters so much—and why embracing transparency is actually your business's secret weapon.

What Transparency Really Means (and Why You Should Care)

Transparency in accounting isn't just about checking boxes for compliance—it's about telling the whole truth, clearly and consistently. It means showing stakeholders exactly what's going on with your finances: the good, the bad, and yes, even the messy.

Modern office interior with transparent glass walls and partitions showcasing an open and airy workspace

Think of it like this: if your business were a house, transparent accounting is the difference between having all the lights on versus trying to navigate in the dark. Sure, turning on the lights might reveal some clutter or repairs you need to handle, but at least you know what you're dealing with.

When you commit to transparency, you're documenting everything, opening up about your financial plans, reporting regularly, and following recognized standards. The result? You're not making your business more unstable—you're just making the natural ups and downs of running a business more visible to everyone who needs to know.

The Volatility Nobody Likes to Talk About

Let's be real: earnings naturally fluctuate. Market conditions shift, customers come and go, costs change, and unexpected expenses pop up. That's just business. But when your accounting practices bring these fluctuations into focus, people sometimes shoot the messenger.

Histogram of S&P 500 Index annualized returns over rolling 3-year periods from 1979 to 2009 showing frequency distribution of performance levels

Volatility—that annoying tendency for your profits to bounce around from quarter to quarter—is rarely caused by how you report your numbers. It's caused by what's actually happening in your business. Transparent accounting simply records these changes as they occur, using systematic methods that help everyone understand why things are shifting.

Fair value accounting is a great example. When you report assets at their current market value instead of what you originally paid, you might see bigger swings in your financial statements. But guess what? Those swings were always there—you're just being honest about them now.

Why Being Transparent Is Worth It

It Builds Trust (Like, Real Trust)

People want to do business with companies they trust. When you're upfront about your finances—even when things aren't perfect—you build credibility with investors, partners, and even your own team.

Think about it: Would you rather work with a company that hides problems until they explode, or one that says, "Here's where we are, here's what we're working on"? Exactly.

It Helps You Make Better Decisions

When you have complete, accurate financial information at your fingertips, you can make smarter calls about where to invest, where to cut back, and where opportunities are hiding.

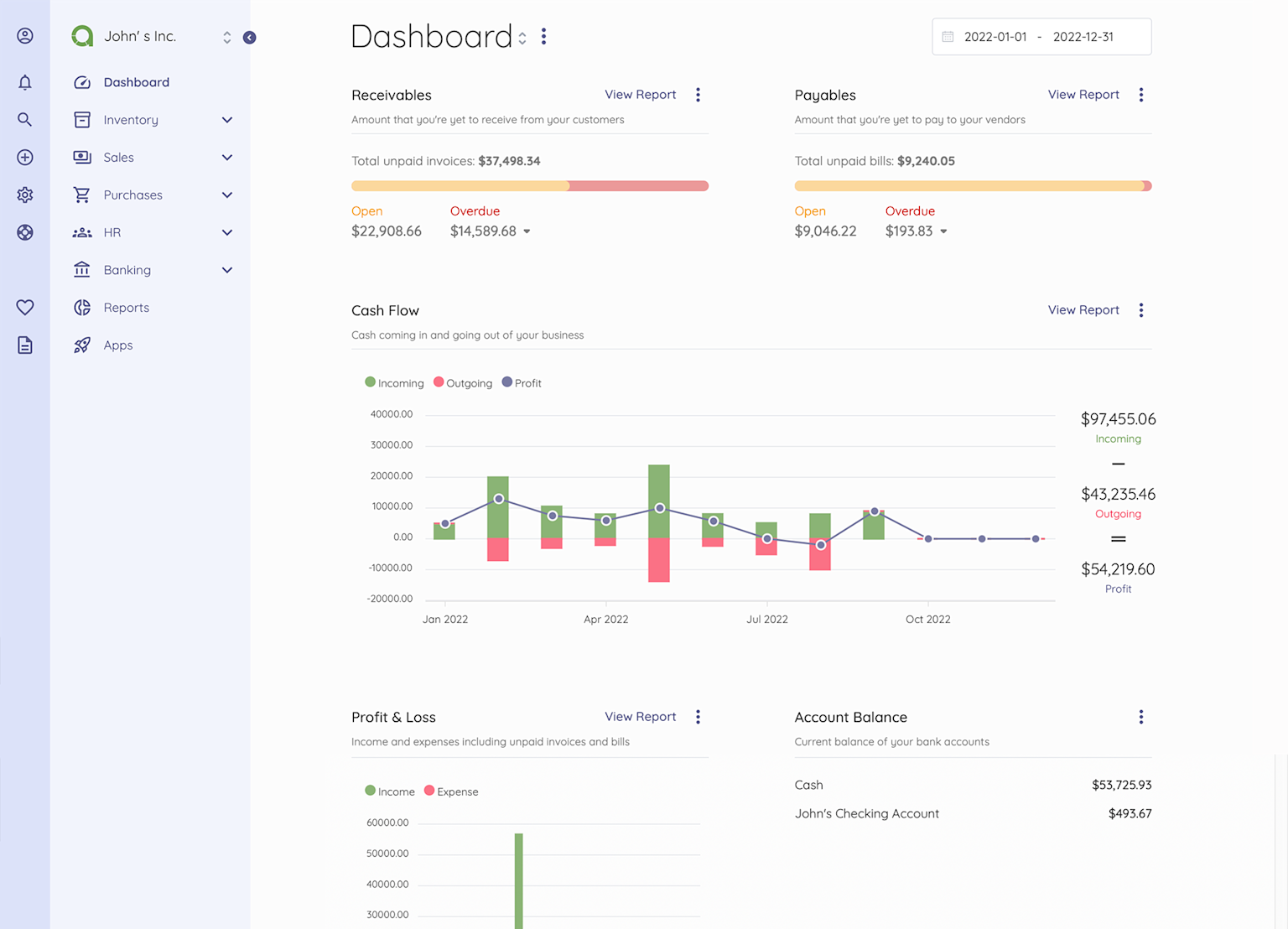

Asian man reviewing financial documents in a modern office setting

Transparent accounting gives you early warning signals about potential problems. Maybe you're spending more on materials than expected, or a certain product line isn't as profitable as it seemed. Catching these issues early means you can actually do something about them.

It Makes You More Attractive to Investors

Here's a secret: investors and lenders aren't looking for perfect financials—they're looking for honest ones. When your books are transparent, the due diligence process is faster, approval is smoother, and you build a reputation as someone worth backing.

Opacity makes people nervous. Clarity makes them confident.

Technology Is Your Friend Here

We're lucky to live in an age where keeping transparent records doesn't mean drowning in paperwork. Modern accounting software, cloud platforms, and even AI-powered analytics make it easier than ever to maintain clear, accessible financial records.

Accounting software dashboard showing receivables, payables, cash flow, profit & loss, and account balances for a business in 2022

Automated audit trails, real-time dashboards, and blockchain technology for immutable records mean fewer human errors and faster insights. You can see exactly where your money is going, and so can everyone else who needs to know.

How to Actually Do This (Without Losing Your Mind)

Report Regularly: Don't save everything for year-end. Regular updates keep everyone informed and prevent surprises.

Document Everything: Keep records of every transaction, every contract, every expense. Future you will be grateful.

Be Approachable: Make yourself available for questions and clarifications. Transparency isn't just about the numbers—it's about the conversation.

Separate Duties: Don't let one person control both reporting and strategy. It keeps things honest and balanced.

Get Audited: Both internal and external audits validate your accuracy and build confidence.

Follow the Standards: Whether it's GAAP, IFRS, or another framework, stick to recognized accounting principles.

The Bottom Line: Clarity Is Your Competitive Edge

Charles Lyell nailed it all those years ago: accounting doesn't create volatility—it reveals it. And while that might feel uncomfortable at first, it's actually one of the smartest things you can do for your business.

When you embrace transparent accounting, you're not just checking off compliance requirements. You're building trust, making better decisions, and positioning your company for long-term success. The market will always have ups and downs. Your job is to navigate them with your eyes wide open.

So turn on those lights. Face the reality of your numbers. And watch how clarity becomes your greatest competitive advantage.

What's been your experience with financial transparency? Have you ever felt pressure to "smooth out" your numbers, or has being upfront made things easier? Drop a comment below—I'd love to hear your story!

Ready to bring more clarity to your financials? Let's talk about how transparent accounting can transform your business. Schedule a 30 minute consultation today.